- Direction:

- GovTech

Ukraine: A Top-Tier Investment Destination

- Publication date and time:

- Reading time:

- 11 min

Ukraine ranks 45th globally and 2nd in Europe by land area. However, its population density has significantly declined due to the full-scale russian invasion, migration, and demographic shifts. According to Worldometer, Ukraine’s population density dropped from 71 people per square kilometer in 2021 to 64.22 in 2024.

This demographic shift affects the business climate, leading to labor shortages in key sectors and potential wage inflation. In response, the Ukrainian government is exploring strategic solutions, including investments and technological advancements, to mitigate these challenges and strengthen economic resilience.

Before the full-scale invasion of russia, Ukraine demonstrated positive entrepreneurship development trends, gradually improving the business environment. According to the latest edition of the World Bank’s Doing Business Index in 2020, Ukraine ranked 64th out of 190 countries, showing steady annual improvements since 2012. Ukraine ranked highly in categories such as obtaining construction permits, registering a business, and paying taxes. Ukraine was viewed less favorably in the most recent Global Competitiveness Report by the World Economic Forum in 2019, in which the country was ranked 85th out of 140. However, even here, Ukraine showed progress, as in 2017, it was ranked 89th out of 135.

Despite the full-scale russian invasion and economic and social difficulties in the context of a major war, Ukraine has demonstrated reasonably good results in the Network Readiness Index. In 2023 and 2024, the country was ranked 43rd out of 134 and 133, respectively, accounting for more than 95% of global GDP. In the Global Innovation Index (GII), which ranks global economies by innovation potential, Ukraine was ranked 55th in 2023 and 60th in 2024. As for the subcomponents of the ranking, Ukraine’s strongest performance is in the areas of People (in the top 25 in the world), Economy, Content, and Future Technologies. At the same time, there is a need to improve performance in the subcomponents’ Inclusiveness, Regulation, Quality of Life, and Contribution to Sustainable Development Goals. Ukraine was ranked 1st among lower-middle-income countries in 2023 and 4th in 2024. Comparing the results in innovation with the level of GDP per capita, Ukraine ranks 6th in the world.

Ukraine in the Network Readiness Index | Ukraine in the Global Innovation Index |

43rd in the world in 2023 and 2024 | 55th in 2023 and 60th in 2024 in the world |

Ukraine in the Global Innovation Index among lower-middle-income countries | Ukraine in the Global Innovation Index comparing the results with GDP per capita |

1st in 2023 and 4th in 2024 | 6th in the world |

Ukraine remains a leader in the utility model sub-index relative to GDP (1st place, as in 2023), in the employment of women with higher education (2nd place), and in the share of software spending in GDP (4th place). The country’s business complexity index has increased (45th position, while in 2023, it was 48th), and so has the online creativity index (39th place, compared to 44th in 2023). Ukraine belongs to the economies whose innovation development is outpacing economic development, and this characteristic applies to a long period — 2014-2024. Indicators in which Ukraine performs particularly well include Internet access in schools, adult literacy, and e-commerce legislation. Negative trends for Ukraine: a decline in indicators related to institutions, human capital, and research; a decrease in foreign direct investment inflows; and pessimism about infrastructure development.

Tax system

One of the main advantages of doing business in Ukraine is its low tax burden compared to other countries in Europe and the world, which makes it attractive to foreign investors. According to the PwC report «Paying Taxes 2020», Ukraine was ranked 65th out of 190 countries regarding ease of paying taxes.

Key taxes in Ukraine: Corporate income tax (18%); VAT (20%, with the possibility of a reduced rate of 7% for certain goods and services); Personal income tax (18%); and the Unified Social Contribution (USC), a requirement for entrepreneurs to pay social insurance.

For example, the level of taxation in the EU countries:

States | Corporate income tax | VAT | Personal income tax |

Ukraine | 18% | 20% | 18% |

Germany | 29.6% | 19% | 0% to 45% |

France | 25% | 20% | 0% to 45% |

Italy | 24% | 22% | 23% to 43% |

Spain | 25% | 21% | 19% to 47% |

Poland | 19% | 23% | 12% to 32% |

Hungary | 9% to 19% | 27% | 15% to 40% |

Investment climate and protection of property rights

Ukraine has several mechanisms to protect property rights, including judicial protection and programs to attract foreign investment. Important for investors are:

The Law of Ukraine «On Investment Activity» provides legal and economic guarantees for investors. It guarantees the inviolability of investments and the impossibility of their nationalization without appropriate compensation, even if changes in legislation occur after the investment. Foreign investors have virtually equal rights with Ukrainian entrepreneurs. Ukraine was ranked 45th in the Doing Business 2020 Minority Investor Protection Index.

The ecosystem of business interaction with the government is based on:

- The Bureau of Economic Security of Ukraine is a Ukrainian law enforcement agency in charge of protecting the state’s economic security, one of whose key tasks is to protect the rights and interests of businesses, fight tax evasion, smuggling, and fraud, and help create a healthy business environment.

- The Antimonopoly Committee of Ukraine (AMCU) is a government agency that ensures state protection of competition in business and public procurement and initiates legislation in this area. The AMCU works to prevent market monopolization, unfair competition and abuse of dominance.

- The Business Ombudsman is an official who protects the interests of Ukrainian and foreign companies doing business in Ukraine before public authorities. The Ombudsman is essential in ensuring legal guarantees for business, acts as a tool for resolving conflicts and disputes between the government and business, and mediates relations between the state and the private sector.

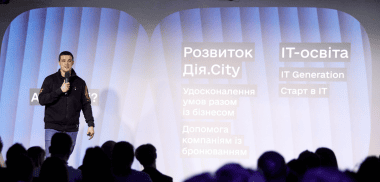

Diia.City and uResidency

Diia.City is a unique legal and tax space for IT companies in Ukraine with liberalized taxation and regulation. This space allows doing business openly, profitably and conveniently, combining comfortable tax conditions with effective tools that will enable companies to build a transparent corporate structure, attract foreign investment more efficiently, and have mechanisms to protect intangible assets. As of March 13, 2025, 1640 Ukrainian and foreign companies are residents of this space. In 2024, 880 new residents joined, which is 2.4 times more than in 2023. In 2023, Diia.City resident companies paid UAH 8.5 billion in taxes, and in 2024 — UAH 18 billion. More than 200 defense-tech manufacturers have registered in Diia.City since last year.

Number of Diia.City residents | Diia.City resident companies’ taxes in 2024 |

1640 companies | UAH 18 billion |

New residents in 2024 | New defense-tech residents in 2024 |

880 | ~200 |

In September 2024, Ukraine launched the uResidency electronic residency program. The program allows foreign entrepreneurs to start a business in Ukraine without needing a physical presence, contributing to the inflow of investments. E-residency in Ukraine is easy to apply for — fill out an application in the application or on the uResidency portal (5-10 minutes). It will be quickly checked, and the resident will receive a digital certificate at the Ukrainian consulate in the country of residence. Then, the entrepreneur opens a self-employment entity online, and all further interactions and reporting will be automatic. Similar programs are available in Estonia — e-Residency, Georgia — Virtual Zone, and several other countries. However, the uResidency program is a uniquely beneficial opportunity for foreigners, as the tax rate will be only 5%. The plan is to attract 1,000 residents in the first year. The focus is on IT professionals from Asia and Europe.

Diia.Business

The Diia.Business platform provides access to business information, support for entrepreneurs, and advice on various issues. It is a Ukrainian state project for developing entrepreneurship and exports, which consists of two components: the online portal Diia.Business and an offline network of 15 entrepreneurial support centers in 14 cities of Ukraine and Warsaw. The mission is to help create a country of entrepreneurs. The Diia.Business portal offers users a unique path depending on the type of business and the stage of its development. Entrepreneurs can quickly and easily find the information they need, from identifying ideas for starting a business to entering foreign markets to getting free advice and a selection of grants. A special focus is on supporting Ukrainian exports. Over 13 million users have visited the project portal in almost 5 years.

In September 2024, Diia.Business was updated. Now, the portal generates trajectories following the current requests of entrepreneurs and saves the most important resource — time. The updated portal also has an improved personal user account, where you can conveniently store the most relevant content about exports, grants, educational programs, training, and other development opportunities. From now on, the most relevant offers will be automatically prioritized in the personal account. The updated portal also has a chatbot that provides users with content on demand. Foreign users can use filters to sort company profiles in the Catalog of Ukrainian Exporters to find potential partners easily.

The updated portal has new sections:

- Diia.Business Start,

- Diia.Business Development,

- Diia.Business Export,

- Diia.Business for Women (according to the World Economic Forum and the Global Innovation Index, countries that actively support women’s entrepreneurial initiatives usually demonstrate a high level of innovation activity),

- Diia.Business for Veterans (significant in the context of Ukraine, as the country will need to return more than 1 million veterans to the economy after the war),

- Diia.Business Digital (section dedicated to business digitalization).

The updated portal also contains:

- a catalog of products and services,

- a test of entrepreneurial skills (Entregram for youth),

- ideas for starting a digital business and more.

Electronic banking services

Electronic banking services are mainly well-developed in Ukraine, making financial transactions more accessible, fast and transparent. Ukraine’s online banking system is, in many ways, an international innovator. The National Bank’s BankID system is a state-owned remote identification system that ensures the transfer of personal data from the bank where the account is opened to the entity that provides the service to the user. The development of digital technologies, particularly in the banking sector, contributes to the development of small and medium-sized businesses.

Innovations in the economy

In early January 2025, the Government approved the Ukrainian Global Innovation Development Strategy (WINWIN) until 2030, which defines Ukraine’s vision of becoming a leading country in technology and innovation. The document outlines the state policy’s strategic goals, principles, directions and objectives to stimulate digital transformation, promote business and startups, and expand international partnerships.

The key areas of the WINWIN 2030 Strategy are opening markets for the latest technologies and innovative products; building and maintaining modern innovation infrastructure; simplifying regulations in the field of innovation; providing access to finance for startups and businesses; human capital development, training and retraining; protection of intellectual property rights; support for knowledge-intensive and inclusive innovations; effective management of state institutions in the field of innovation; creation of centers of excellence (WinWin CoE) for each of the key sectors.

Priority Industries of WINWIN Innovation Strategy:

DefenseTech, MedTech, AI, EdTech, Agritech, GovTech, GreenTech, Semiconductors, immersive technologies, Space Technologies, UAVs, Secure Cyberspace and Borderless Fluid Economy.

Spatial initiatives

An industrial park is a territory allocated in a city for industrial development. Such parks are created to provide enterprises with common infrastructure and control over production and environmental impact. Industrial parks may also enjoy certain tax benefits. Ukraine already has a law regulating their activities. Companies located in an industrial park can count on the following preferences: exemption from paying income tax for 10 years (but the released funds must be spent on developing such an enterprise), exemption from paying VAT and import duties on importing new equipment.

Thanks to legislative incentives, the number of active industrial parks in Ukraine increased from 4 to 20 over the three years of the large-scale war. As of December 2024, 97 industrial parks were registered in Ukraine, including 51 during the full-scale war. 70% of new industrial parks registered by the Government declare the presence of investors.

Total of industrial parks in Ukraine | Active industrial parks in Ukraine |

97 | 20 |

Technology parks implement projects for the production implementation of knowledge-intensive developments in high technologies and ensure the industrial production of competitive products. There are currently 16 technology parks in Ukraine, of which only eight are implementing projects.

Total of technology parks in Ukraine | Active Technology Parks in Ukraine |

16 | 8 |

The science park is a center for commercializing research results and their implementation in foreign and domestic markets, using scientific and educational potential. It is created based on and/or on the initiative of a higher education institution and/or a research institution. Currently, 37 science parks are registered in Ukraine, of which only five are engaged in innovation.

Total of science parks in Ukraine | Active science parks in Ukraine |

37 | 5 |

In January 2025, as part of the WINWIN Innovation Digital Development Strategy of Ukraine, the Ministry of Digital Transformation of Ukraine and the Ministry of Education and Science of Ukraine announced the launch of the Science City project to transform science parks into modern innovation centers. Science City is a comprehensive reform of science parks that will create conditions for cooperation between research institutions, universities, businesses, and the state. This initiative will help overcome barriers that hinder innovation and integrate science parks into the Diia.City legal regime, and facilitate technology transfer in Ukraine. In three to five years, it is planned to increase the number of active science parks from 5 to 15, increase the turnover of science parks to UAH 1-1.5 billion, raise the revenues of universities and research institutions to UAH 750 million per year, which will create 1,500 new jobs in the science and technology sector.

Science City reform — number of active science parks increase from 5 to 15 | Science City reform — turnover of science parks ~UAH 1-1.5 billion per year |

Science City reform -revenues of universities and research institutions ~UAH 750 million per year | Science City reform — new jobs in the science and technology sector ~1,500 |

So far, Ukrainian legislation has not yet formalized another type of park — innovation parks. These ecosystems for entrepreneurship and research provide infrastructure and an innovation ecosystem for IT and technology companies and help them move into the global market. The first innovation park in Ukraine was opened in 2017 — UNIT.City in Kyiv. In 2017, an innovation park was also opened in Ivano-Frankivsk — Promprylad.Renovation. In 2020, the LvivTech.City Innovation Park was opened in Lviv. In 2021, the launch of an innovation park in Kharkiv, Ecopolis HTZ, was announced, but the project is on hold due to the full-scale invasion of russia.

UkraineInvest portal

UkraineInvest is a government investment facilitation and support program established in 2018 to attract foreign direct investment and help existing investors expand their businesses in Ukraine. UkraineInvest has helped attract more than $4 billion in foreign direct investment. UkraineInvest provides investors with comprehensive support, reliable and up-to-date information on optimal investment opportunities, legal assistance and advice on doing business in Ukraine. It also facilitates communication between investors and government agencies at all levels and supports solving systemic problems investors may face. There are also various tax incentives for foreign investors in Ukraine. The most popular are preferential tax rates for specific business categories or certain regions, tax holidays for investors in priority sectors such as agriculture or innovative technologies, and exemption from income repatriation tax for foreign investors.

Digitalization has become an important factor in improving the business environment in Ukraine. Post-war Ukraine has no other choice but to become an investment paradise in order to recover from the terrible consequences of Russia’s invasion and become a developed economy and a contributing member of the European and global community.

The article was prepared by the Kyiv Global Government Technology Centre Team. The Centre is supported by the World Economic Forum, the Ministry of Digital Transformation of Ukraine, and Switzerland under EGAP Program, implemented by East Europe Foundation.