- Direction:

- IT

Ukraine’s IT Shift: From Outsourcing to Innovation

- Publication date and time:

- Reading time:

- 8 min

Over the past decade, the IT market in Ukraine has consistently attracted public interest and has repeatedly become a topic of public discussion. The interest is provoked by high salaries in this area, a low entry threshold for active young people, annual revenue growth rates, and a significant export orientation.

In this article, we will try to outline the IT sector in Ukraine based on quantitative data from the research of the IT Ukraine Association («Digital Tiger: the Power of Ukrainian IT — 2023»), u.ventures (Scaling Up: Accelerating Ukraine’s Tech Sector), StartupBlink (Global Startup Ecosystem Index 2024), DOU (Top 50 IT Companies in Ukraine, Winter 2025), YouControl (IT Development in Ukraine: Current Situation and Prospects), Lviv IT Cluster (IT Research Ukraine 2024).

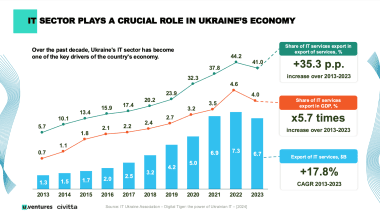

As of 2020-2021, the contribution of IT to Ukraine’s GDP was approximately 2%, more than doubling since the early 2010s, when it ranged from 0.5-1% according to various sources. After the full-scale invasion in 2022, this share increased to 4.5% due to the loss of a significant part of the metallurgy industry and the temporary suspension of agricultural exports. In 2023 and 2024, after agricultural exports resumed in full, the share of IT in Ukraine’s GDP fluctuated between 3.7-3.5% of GDP. The IT industry has become the second-largest export industry, accounting for approximately 37-42% of services exports and 11-13% of total exports of goods and services, second only to agricultural exports. Exports of Ukrainian IT services amounted to $7.3 billion in 2022 (an all-time record), $6.7 billion in 2023, and $6.45 billion in 2024.

The share of IT in Ukraine’s GDP in 2022-2024 | Exports of Ukrainian IT services in 2022-2024 |

3.7-3.5% | $6.4-7.3 billion |

Before the full-scale russian invasion, Ukrainian IT was growing at a very fast pace — exports of IT services from Ukraine grew by an average of 27% annually, and in 2021 grew by 36%. This trend was expected to continue. In Q4 2021, Ukrainian IT companies exported services worth $2.1 billion. In 2024, the average quarterly export amounted to $1.6 billion, and IT exports fell by almost 25%.

Despite the decline in exports of services, the IT sector still provides significant foreign exchange earnings to Ukraine’s economy, mainly selling services to companies registered in the United States ($2.4 billion in 2024), the United Kingdom ($0.6 billion) and Malta ($0.5 billion), Cyprus, Israel, Switzerland, and Germany. Of these revenues, the IT sector pays approximately UAH 20 billion ($0.5 billion) in taxes to the budget annually.

According to various estimates, there are approximately 2,100-2,300 IT companies in Ukraine. In total, according to some estimates (mainly data for October-November 2024), the country’s IT industry employs between 302,000 and 346,000 people.

IT companies in Ukraine | IT specialists in Ukraine |

2,100 — 2,300 | 302,000 — 346,000 |

More than 52% of IT companies are registered in Kyiv, and approximately 67% of the total net income declared by IT companies in Ukraine is concentrated in the city (in 2022, UAH 123.7 billion out of UAH 184.4 billion). Significant revenues of IT companies are also concentrated in Lviv (10.4% of revenues), Kharkiv (8.1%), Dnipro (4.2%), Vinnytsia (3.4%), and Odesa (1.7%) regions.

Share of IT companies in Kyiv | Share of IT companies’ income in Kyiv |

52% | 67% |

As of September 2024, there were more than 275 thousand active individual entrepreneurs registered under IT-related business codes in Ukraine. The largest number of active IT sole proprietorships is registered in Kyiv and Kyiv region (30%), Kharkiv (12%), Lviv (11%), and Dnipro (8%).

As of January 2025, the top 50 largest IT companies in Ukraine employed 79,648 specialists. In 2024, the number of employees in the top 50 companies decreased by 2.4 thousand, while in 2023 there was a decrease of 10 thousand. Among the 50 largest companies in Ukraine, there are 25 service companies, one outstaffing company, 19 product companies, and five hybrid companies. 46 companies have offices in Kyiv, 23 in Lviv, 15 in Dnipro and Odesa, 14 in Vinnytsia, 11 in Ivano-Frankivsk, and 10 in Kharkiv.

Because of the invasion, two-thirds of IT companies in Ukraine have made unplanned relocations within the country and abroad, a quarter of them completely. Before the full-scale invasion, more than 70% of IT employees lived in Kyiv, Lviv, and Kharkiv. Kharkiv has undergone the biggest changes during the war: out of 14% of IT employees as of 2021, 4% now live in the city. The share of IT workers living in Lviv increased from 14% in 2021 to 18% now.

About 120,000 highly skilled Ukrainian IT specialists went abroad because of the war, of which about 62,000 to 64,000 continued to work for Ukrainian companies. Currently, about 20% of Ukrainian IT specialists work abroad. According to the IT Research Ukraine 2024 survey, 51% of company executives plan to expand offices abroad and more than a third of them intend to open new ones. 6% of managers announced plans to close their offices in Ukraine.

Number of Ukrainian IT specialists who went abroad because of the war | Number of Ukrainian IT specialists abroad, who continued to work for Ukrainian companies |

~120,000 | ~62-64,000 |

At the same time, the integration of Ukrainian specialists into the European and American IT markets allows for the creation of new networks to attract investment and business to the Ukrainian economy.

Startups

The Ukrainian startup ecosystem is one of the three fastest growing ecosystems in Central and Eastern Europe (CEE) and the fourth largest in the region by value. Since 2020, the estimated value of Ukraine’s tech ecosystem has tripled to more than $25 billion. According to recent estimates, there are approximately 2,600 IT startups in Ukraine.

Estimated value of Ukraine’s startup ecosystem | Number of IT startups in Ukraine |

~$25 billion | ~2,600 |

The StartupBlink research center, which compiles the Global Startup Ecosystem Index 2024, ranked Ukraine 46th out of 100 countries. After a sharp decline of 16 points in 2022, Ukraine has risen 3 places for the second year in a row.

With the onset of the full-scale invasion, 12% of Ukrainian startups were forced to cease operations. At the same time, 200 new startups appeared in Ukraine in 2022-2023. In 2024, 100 investment deals took place, with public investment totaling $350 million.

Ukraine is among the top ten countries from which the founders of unicorn startups originated. There are currently 8 startups founded by Ukrainians that have a valuation of more than $1 billion: Bitfury, Grammarly, People.ai, Unstoppable domains, GitLab, Firefly, Creatio, airSlate.

Diia.City plays an important role in stimulating the development of startups. It is a special legal regime that creates a comfortable environment for startups and R&D centers. The Ukrainian Startup Fund supports projects that can be used during the war and for post-war modernization.

In February 2024, 10 of Ukraine’s largest tech companies — Ajax Systems, Genesis, Monobank, MacPaw, Roosh, Reface, Gathers, Nova Digital, Mate academy, Netpeak Group — presented the Diia.City United community. The goal is to develop the Diia.City ecosystem, create fair rules of interaction between the government and the tech sector, and develop educational programs to help Ukrainian IT companies grow globally.

In November 2024, the Ministry of Digital Transformation and the Lviv IT Cluster launched the CodeUA platform. This is a B2B platform that connects Ukrainian companies with international clients to implement projects. Through the platform, you can order software development, IT consulting, cybersecurity, data analysis, design, and technical support services.

Outsourcing as the first stage of the IT sector development

Ukraine is a global technology hub, ranking 7th in the world in terms of IT competitiveness and in the top 5 global rankings in terms of IT professionalism. The high qualification of Ukrainian IT specialists is shaped by a developed educational ecosystem.

At the same time, when specialists work as outsourcers for foreign companies, the country and the state budget receive much less revenue, as they receive only taxes from the specialists' income. The specialist’s work creates value for the foreign company, which generates profit and pays taxes to the budget of the country where it is registered, which means much more taxes.

Under favorable conditions, the next stage should be a systematic transition of IT professionals from outsourcing to using the experience gained in foreign companies to develop their own products and create startups. The formation of as many product IT companies as possible — companies that do not outsource services but develop their own technical products — is the next step in the development of the Ukrainian IT sector.

MilTech

An obvious trend in the context of Russia’s full-scale invasion is the growth of the miltech sector. There are more and more startups and companies developing drones, electronic warfare systems, AI navigation systems, and much more. About 25% of investment deals in 2024 were in the defense technology sector. In 2024, the number of vacancies in the defense sector increased by 56%, which indicates a significant increase in interest in this area. This general trend is likely to continue.

AgroTech

AgroTech is a sector that works to integrate technological solutions into strategically important sectors of the economy: agriculture, food, bioenergy, and logistics. In February 2025, an expert group under the Ministry of Digital Transformation of Ukraine in cooperation with the IT Ukraine Association presented the AgroTech development strategy, part of the Digital Innovation Development Strategy 2030 (WINWIN), with a focus on digitalization, automation, and efficiency improvement in agriculture and the food industry.

This will be achieved through the introduction of artificial intelligence, the Internet of Things, drones, and robotic systems to optimize production and resources, which will create new opportunities for economic growth, strengthen Ukraine’s position in the global market, and allow it to move from exporting raw materials to producing innovative products with high value. These technologies will also help to overcome the shortage of staff caused by the war, as well as to help demine and increase the productivity of agricultural land.

AI ecosystem of Ukraine

As of January 2024, the number of IT companies working in the AI field reached 243. As of 2023, 106 specialized AI programs were available at 42 Ukrainian universities. Over the past 10 years, the number of AI/ML specialists in Ukraine has increased 5 times and now amounts to more than 5000 people. At the same time, there is an active migration of specialists abroad due to the war.

Number of Ukrainian IT companies working in the AI field | Number of AI/ML specialists in Ukraine |

243 | ~5000 |

There are 40-50 Ukrainian and international venture capital funds and accelerators that invest in AI startups. There are also more than 30 artificial intelligence laboratories from major IT companies and universities.

Challenges and what needs to be done

In the context of a full-scale war, Western investors are afraid to invest heavily in Ukraine, considering such investments risky. They are also cautious about ordering services from Ukrainian specialists and companies because of the risks involved. The decline in investment and overall money inflows, along with the decline in local purchasing power, slows down the development of the IT sector, which in turn leads to an outflow of both young and experienced professionals, scientists, and entrepreneurs.

At the same time, it is necessary to introduce changes that will help the sector at least to some extent during the war and significantly strengthen it in peaceful conditions. These include simplifying regulatory barriers, eliminating gaps in legal protection of investors and intellectual property rights, facilitating free capital flows between key tech hubs, and increasing funding for the startup ecosystem in the form of ideatons, hackathons, incubation programs as well as acceleration support, and investments in research and development (R&D).

The article was prepared by the Kyiv Global Government Technology Centre Team. The Centre is supported by the World Economic Forum, the Ministry of Digital Transformation of Ukraine, and Switzerland under EGAP Program, implemented by East Europe Foundation.